Scammers Are Evolving. So Should Your Defenses.

October 24, 2025

At NASA Federal Credit Union, we’re committed to helping you protect what matters most: your financial well-being. As scammers continue to develop new and ever-more sophisticated techniques to trick consumers, staying in the know is your first line of defense. Here are the latest fraud trends and how to spot them.

Fraud Trends

Traffic Ticket Scam

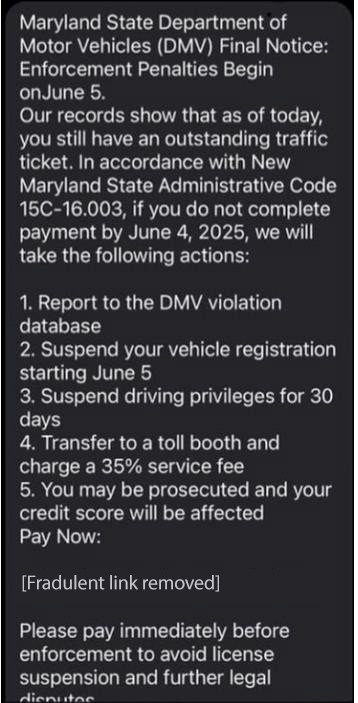

The Scenario: Similar to the recent toll scam, you may receive a text message claiming you have an outstanding unpaid traffic ticket from your state's Department of Motor Vehicles.

Red Flag: Scammers will urge you to "Pay Now" or face multiple disciplinary actions if the payment isn't made. The message contains a fraudulent link directing you to a fake website designed to look like a legitimate toll payment portal where scammers can steal your credit card information or add malware to your phone.

Stay Safe: Do not visit the website or click on any links. Do not share your bank card, passcodes or PINs. If you have questions about your vehicle, go directly to your state's official Department of Motor Vehicles website.

Student Internship Funding Scams

The Scenario: After a brief online “interview,” a scammer posing as an employer offers you a remote internship or part-time job and tells you that you will receive a check to cover equipment or training costs.

Red Flag: You’re instructed to deposit the check, keep a portion, and send the rest back via wire transfer, Zelle®, or gift cards. The check later bounces.

Stay Safe: Never send money or gift cards to someone who sends you a check out of the blue. Verify job offers directly through company websites or official university channels.

Fake Payment Receipt Scams

The Scenario: You receive an email that looks like a receipt for a large payment or purchase through PayPal or another merchant that you don’t recognize.

Red Flag: The message says that you should click a link to dispute or cancel it if you did not make it.

Stay Safe: Don’t click on links or download attachments. Check your actual bank account or credit card activity through trusted channels, not the email link.

Social Media-Based Investment Scams

The Scenario: Scammers promote “get rich quick” stock schemes, often via social media messages. They may include links that install malware or attempt to take over your accounts.

Red Flag: An unsolicited investment tip that seems too good to be true.

Stay Safe: Avoid clicking unknown links. Only invest through licensed professionals and verified platforms.

Real Estate and Vehicle Scams

The Scenario: Fraudsters copy real listings for homes or cars and change the contact info, posing as the agent or seller. They pressure you to pay upfront using wire transfers or gift cards.

Red Flag: Unusual payment methods or being asked to pay before seeing the property or vehicle.

Stay Safe: Verify listings through official channels and never send money without verifying the seller.

Tech Support Scams

The Scenario: Scammers pose as tech support from a well-known company and claim your device is infected.

Red Flag: They’ll ask for remote access, or worse, your login credentials and security codes.

Stay Safe: Never give remote access to someone you don’t know. Don’t share passwords, account numbers, or one-time passcodes. If you’re unsure, end the conversation and contact the company directly through official channels.

IRS Scams

The Scenario: Scammers pretend to be from the IRS or tax services, claiming there’s an issue with your return.

Red Flag: They’ll pressure you to click a link or provide personal details like your Social Security number or banking info.

Stay Safe: The IRS does not initiate contact via email, text, or social media. Visit the IRS website directly if you have tax concerns.

Become Skilled at Spotting the Imposter

Imposters often claim to be:

- A bank or government official warning of fraud

- An IRS agent demanding tax payments

- A romantic partner in crisis

- Tech support offering to fix your computer

- A delivery service claiming a failed shipment

- An employer requesting personal information

Common red flags include:

- Urging you to move money into a “new” account

- Asking for passwords, PINs, or one-time codes

- Requesting remote access to your device

- Instructing you to ignore security warnings

- Telling you to type special codes into your phone (*72, **21, etc.)

Stop. Think. Don’t be fooled.

- Pause. Don’t be rushed, as scammers rely on panic.

- Verify. Contact organizations using trusted sources (like your account statement or the back of your card).

- Prevent. Talk about scams with friends and family to help others stay informed.

Stay Alert. Stay Protected.

Fraudsters rely on urgency and fear to trick people into giving up sensitive information. Slow down, think critically, and don’t hesitate to contact NASA Federal Credit Union if something doesn’t feel right. Our team is here to support and protect you.

If you think you’ve been targeted by a scam or suspect fraud on your account, contact us immediately at 1-888-NASA-FCU. A Member Service Associate will be happy to assist you.